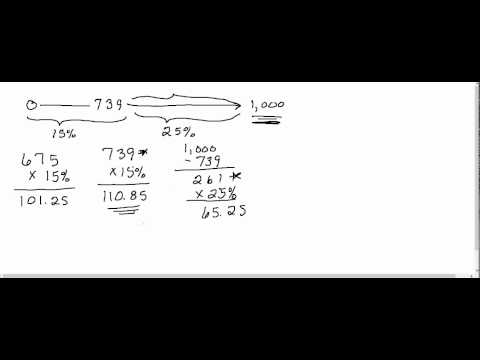

Okay, we're going to look at the arithmetic you need to do in order to figure out the federal income tax. So, what we have is a value of seven hundred thirty-nine dollars, which is the difference between the lower-tier tax and the upper tier. What that means is if your income is anything from zero to seven hundred thirty-nine dollars, you will be taxed at a rate of 15 percent of that income. If your income is greater than seven hundred thirty-nine dollars, they will tax that portion of it at a rate of 25 percent. So, what exactly does that mean? Well, let's take an example. Let's say that your taxable income is six hundred seventy-five dollars. Okay, you're going to pay fifteen percent of that as federal income tax, and it's just a simple multiplication. Multiply the 15% times your $675 taxable income, and you will pay 101 dollars and twenty-five cents in federal income tax. That's what will be withheld if you're in the maximum value for that range. Let's say your taxable income is seven hundred and thirty-nine dollars. Again, you're going to pay fifteen percent of that out as federal income tax. Okay, so again, multiplication. Seven hundred thirty-nine times fifteen percent is one hundred ten dollars and eighty-five cents. So, that's the maximum you will pay in federal income tax if your income is from zero to seven hundred thirty-nine dollars, because 739 dollars is the maximum amount. It's just a straight multiplication of your taxable income times the 15%. But what happens if your income is greater than that 739 dollars? How do they figure that? Well, let's take an example. Let's say your taxable income is a thousand dollars. Okay, you're still going to pay fifteen percent of that first seven hundred and thirty-nine...

Award-winning PDF software

Income tax canada calculator Form: What You Should Know

Canada — Individual — Summary and breakdown by tax bracket. Canada — Nonresident Tax Calculator — Fidelity Investments Tax calculations— Fidelity Investments Canada Tax Calculator— Fidelity Investments Canada Individual Tax Calculator May 18, 2025 — The IRS has released its updated 2025 and 2025 Individual Income Tax Tables. The Taxpayer Advocate Service has provided these tables as a free resource. You may view and download the Taxpayer Advocate's publication, Individual Income Tax Tables. 2017 Tax Tables — Individual Income Tax Brackets. You may download the 2025 Individual Income Tax Tables using the link on the left. This spreadsheet is available in both Microsoft Excel and Google Sheets formats. 2015 Tax Tables — Individual Income Tax Brackets. You may download the 2025 Individual Income Tax Tables. This spreadsheet is available in both Microsoft Word and Google Sheets formats. Tax Calculator and Schedules You can download Excel templates for tax calculation of various types of income. These template files, called “tax calculators,” require you to input your income information and create a tax return. The calculations are generated automatically, which can help you identify areas in which you are entitled to a refund in light of the changes that have been made to the Canada Revenue Agency's 2025 Income Tax Calculator. These tax calculators are not intended to substitute for professional advice. The Scheduled Filing Season for 2025 is now open and will end May 18, 2016. We can't say when the 2025 Form T2038B (“Tax Calendar”) for your personal income tax will be released, but it will be before the end of June. There will be an additional extension from June 1 to August 1 for the 2025 Tax Calendar. If you are having a tough time getting a professional to help you. The Revenue Canada's Professional Employers' Tax Center can give you advice on your potential tax situation and how to prepare your return. To contact them and get more information, you can call toll-free from 7 a.m. to 8 p.m., Monday to Friday, and Saturday from 8 a.m. to 4 p.m. You may purchase Excel templates for tax calculation of various types of income. These template files, called “tax calculators,” require you to input your income information and create a tax return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Canada T7dr(a), steer clear of blunders along with furnish it in a timely manner:

How to complete any Canada T7dr(a) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Canada T7dr(a) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Canada T7dr(a) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Income tax canada calculator