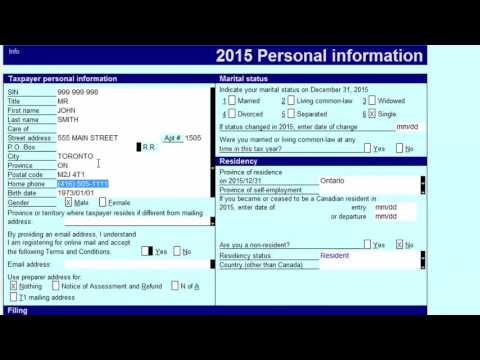

Hey everybody, welcome! This is my YouTube series on preparing Canadian personal tax returns. My name is Ian De Novo, and I'm a professional accountant in Toronto and the founder and instructor at Canadian Tax Academy.com. We offer practical real-world training courses in personal income tax, corporate income tax, and other tax areas. If you're interested in taking some personal tax courses, check out the description section here on YouTube for promotions or the pop-up bubbles that appear occasionally. Our prices are competitive compared to other options in the world of Canadian tax. Now, let's get started with the training series. In this series of four tutorials, I will teach you how to prepare a basic Canadian T1 tax return. In the first part of this series, we will focus on preparing personal tax returns. This video will cover the identification and personal information portion of the T1 tax return. You might think that this part is straightforward and easy, but believe me, many mistakes can occur if you don't enter the correct information. I won't show you how to fill it in since you know your personal information, but I'll highlight the important areas and what can go wrong if the information isn't accurate. Most software packages have an information worksheet where you enter all the details for your tax return. If you're preparing tax returns for clients, it's crucial to be careful with the information you enter here. This information page will be automatically transferred to the T1 General return on page one and part of page two. Let's start with the identification section. This includes your name, address, and mailing address. If you want to sign up for CRA webmail, you can enter your email address here, which is a relatively new option in the tax landscape. Next, we have information about...

Award-winning PDF software

Cra s 2025 Form: What You Should Know

Forms and Publications — Canada.ca June 1, 2025 — Each package includes the guide, the return, related schedules, and the province or territorial schedules. Forms and publications — Canada.ca July 23, 2025 — This is the main menu page for the T1 Personal income tax and benefit for 2019, to get the forms and information needed to file a T1 General personal tax and benefit return for 2025 to be filed with Revenue Canada. This is the main menu page for the T1 Family income tax and benefit for 2019, to get the forms and information needed to file a T1 General family tax and benefit return for 2025 to be filed with Canada Revenue Agency (CRA). Forms and Publications — Canada.ca Forms and publications for businesses — Canada.ca Forms and publications for students — Canada.ca Feb 4, 2025 — This is the main menu page for the T1 Business income tax and benefit for 2019, to get the forms and information needed to file a T1 General business tax and benefit return for 2025 to be filed with Revenue Canada. This is the main menu page for the T5 Education and Training tax credits, to get the forms and information needed to file a T5 Income Tax and National Amount student grant or refund. Tax packages for all years — Canada.ca Feb 1, 2025 — Each package includes the guide and the return, related schedules, and the province or territorial schedules, information, and forms. Forms, publications, and information. For information on the T4 General provincial part, visit CPP/PPP and Canada Pension Plan/PPP. Forms and publications for businesses — Canada.ca Forms and publications for students — Canada.ca Forms — Canada.ca Forms — Canada.ca For tax applications completed with your professional tax services tax account, CRA will mail you the application forms. Dec 31, 2025 — This is the main menu page for the T1 General personal income tax and benefit for 2028. There is a menu of tax forms to get to know about for each tax year.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Canada T7dr(a), steer clear of blunders along with furnish it in a timely manner:

How to complete any Canada T7dr(a) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Canada T7dr(a) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Canada T7dr(a) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cra forms 2025